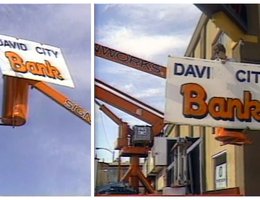

The David City Bank failed in 1984. It was the 55th commercial bank in the United States to fail that year. In this case, the Nebraska State Banking Director declared that the bank was no longer solvent. The bank’s assets were turned over to the FDIC, which began to liquidate the assets of the loans.

Farmers in the surrounding area were facing a new crisis with the failure. Borrowers were sure that there would be foreclosures, and that farmers would be forced to sell their farms and livestock. There just weren’t any other banking institutions that would be willing to loan additional money to farmers who already owed money to the David City Bank.

"They treat you like you’ve got leprosy," one farmer said when he applied at a nearby community. Another farmer said four banks had turned him down, and it was becoming impossible to get any funds to operate on.

Neighboring banks said they already had troubled farm loans of their own and couldn’t take on any more new borrowers. The other bank in David City, First National, was extending some loans to farmers, but they were very cautious.

Business people and farmers in the David City area speculated that perhaps 30 to 40 former David City Bank borrowers would lose their farms by the winter of 1984.

To help fix the problem, the FDIC tried to find a buyer for the failed bank. They invited several Nebraska banking interests to submit sealed bids for the purchase of the David City Bank. The successful bidder was First National Bank of Omaha. They purchased the bank building, its bond portfolio and assumed responsibility for all of the deposit liabilities, which amounted to $17.4 million. First National Bank officials examined all outstanding loans and assumed those that were termed "good loans." The so-called "bad" loans were turned over to the FDIC, which then attempted to collect them or otherwise convert the collateral into cash.

Critics were worried that First National only bought a few of the good loans and turned over too many "bad" loans to the FDIC for liquidation. The bank reported that they had taken back about a fourth of the original 297 farm loans, and that they might take back more farm borrowers in the future.

David City was left with two banks as a result of the change in ownership of the David City Bank — First National Bank of Omaha/David City Branch and First National Bank of David City.